How to Trade Digital Options on Quotex

Digital options trading is a straightforward yet dynamic way to invest in financial markets. On Quotex, one of the leading platforms for digital options, traders can predict the price movement of various assets, including stocks, commodities, cryptocurrencies, and indices.

The platform provides a user-friendly interface and tools to help traders make informed decisions, whether they are beginners or experienced investors.

The platform provides a user-friendly interface and tools to help traders make informed decisions, whether they are beginners or experienced investors.

What are Digital Options?

Option is a derivative financial instrument based on any underlying asset, such as a stock, a currency pair, oil, etc.DIGITAL OPTION - a non-standard option that is used to make a profit on price movements of such assets for a certain period of time.

A digital option, depending on the terms agreed upon by the parties to the transaction, at a time determined by the parties, brings a fixed income (the difference between the trade income and the price of the asset) or loss (in the amount of the value of the asset).

Since the digital option is purchased in advance at a fixed price, the size of the profit, as well as the size of the potential loss, are known even before the trade.

Another feature of these deals is the time limit. Any option has its own term (expiration time or conclusion time).

Regardless of the degree of change in the price of the underlying asset (how much it has become higher or lower), in case of winning an option, a fixed payment is always made. Therefore, your risks are limited only by the amount for which the option is acquired.

What are the varieties of Digital Options?

Making an option trade, you must choose the underlying asset that will underlie the option. Your forecast will be carried out on this asset.

Simply, buying a digital contract, you are actually betting on the price movement of such an underlying asset.

An underlying asset is an “item” whose price is taken into account when concluding a trade. As the underlying asset of digital options, the most sought-after products on the markets usually act. There are four types of them:

- securities (shares of world companies)

- currency pairs (EUR / USD, GBP / USD, etc.)

- raw materials and precious metals (oil, gold, etc.)

- indices (SP 500, Dow, dollar index, etc.)

There is no such thing as a universal underlying asset. When choosing it, you can only use your own knowledge, intuition, and various kinds of analytical information, as well as market analysis for a particular financial instrument.

How to Trade Digital Options?

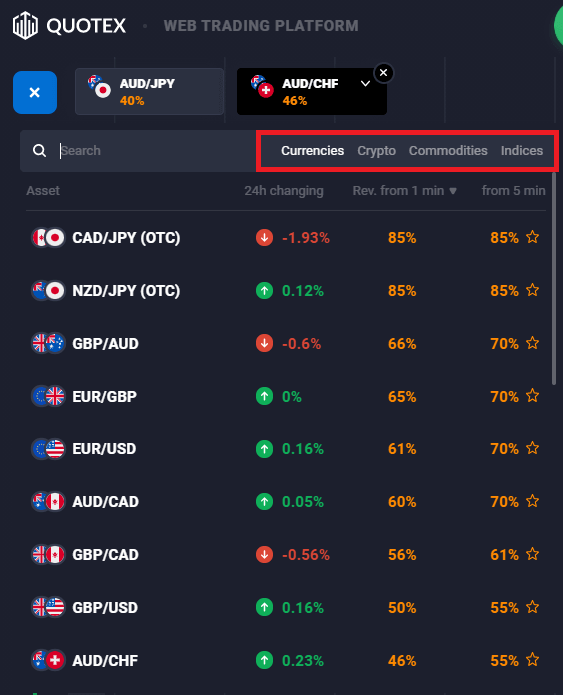

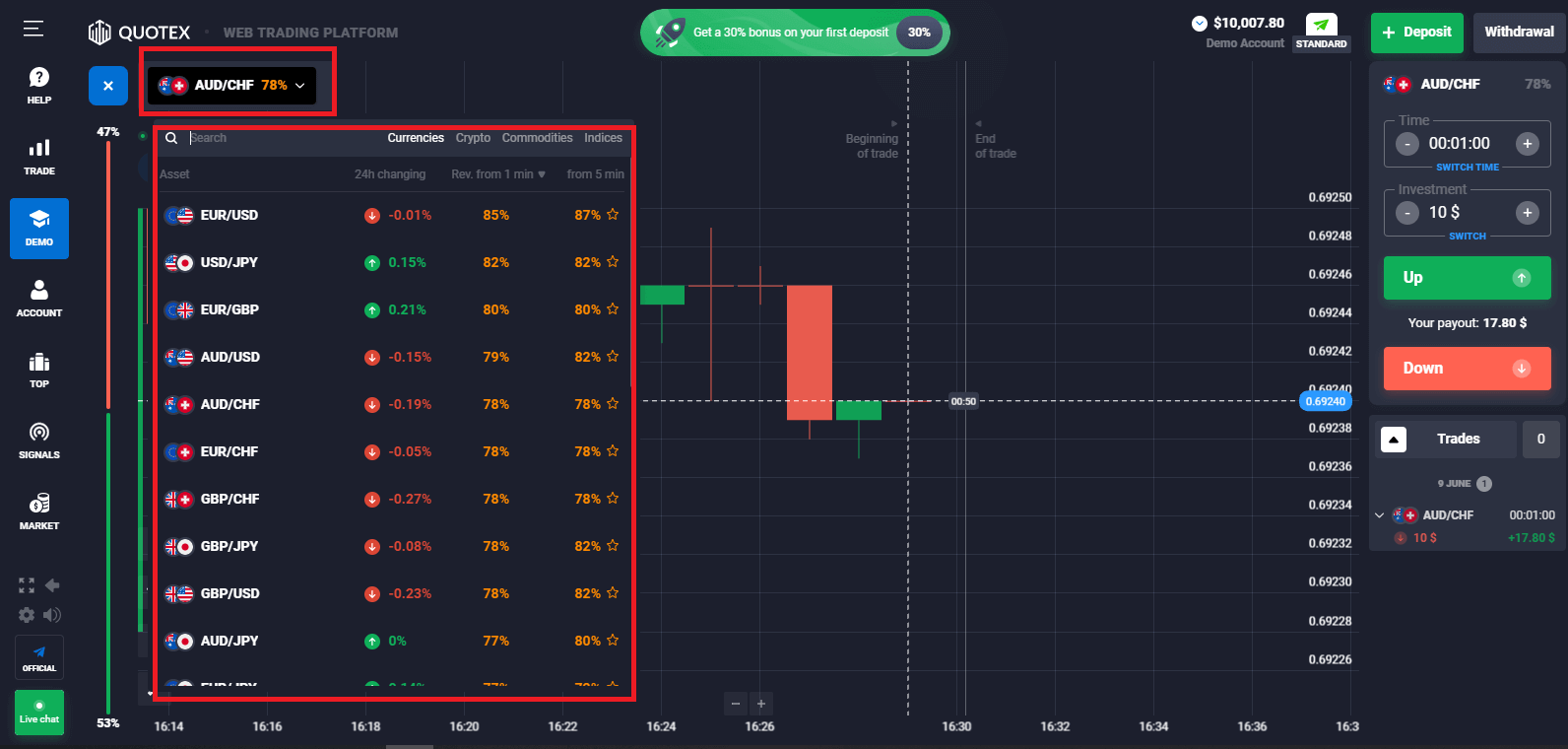

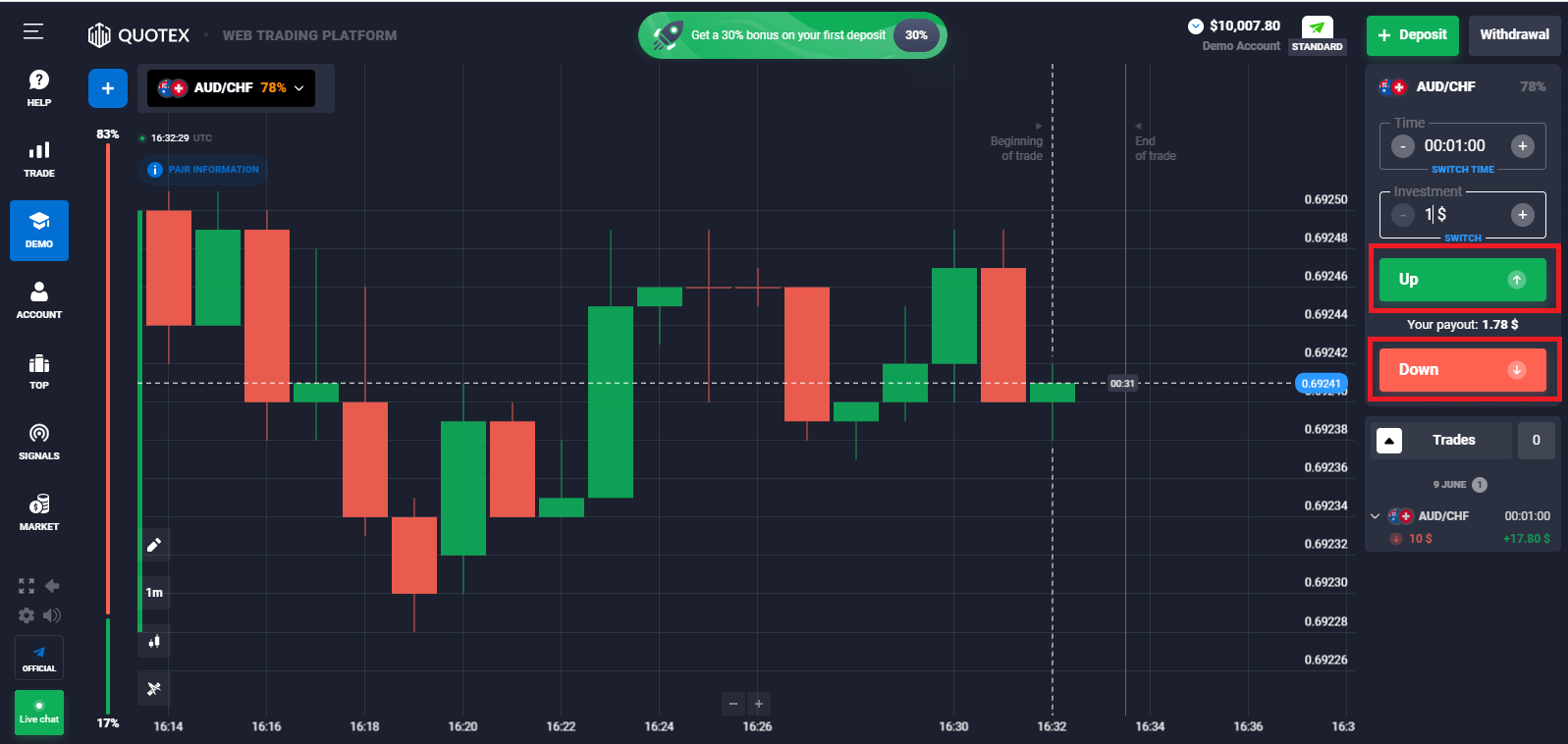

1. Choose asset for trading: Currencies, Commodities, Crypto or Indices

- You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

- You can trade on multiple assets at once. Click on the “+” button left from the asset section. The asset you choose will add up.

The percentage next to the asset determines its profitability. The higher the percentage – the higher your profit in case of success.

Example. If a $10 trade with a profitability of 80% closes with a positive outcome, $18 will be credited to your balance. $10 is your investment, and $8 is a profit.

Some asset’s profitability may vary depending on the expiration time of a trade and throughout the day depending on the market situation.

All trades close with the profitability that was indicated when they were opened.

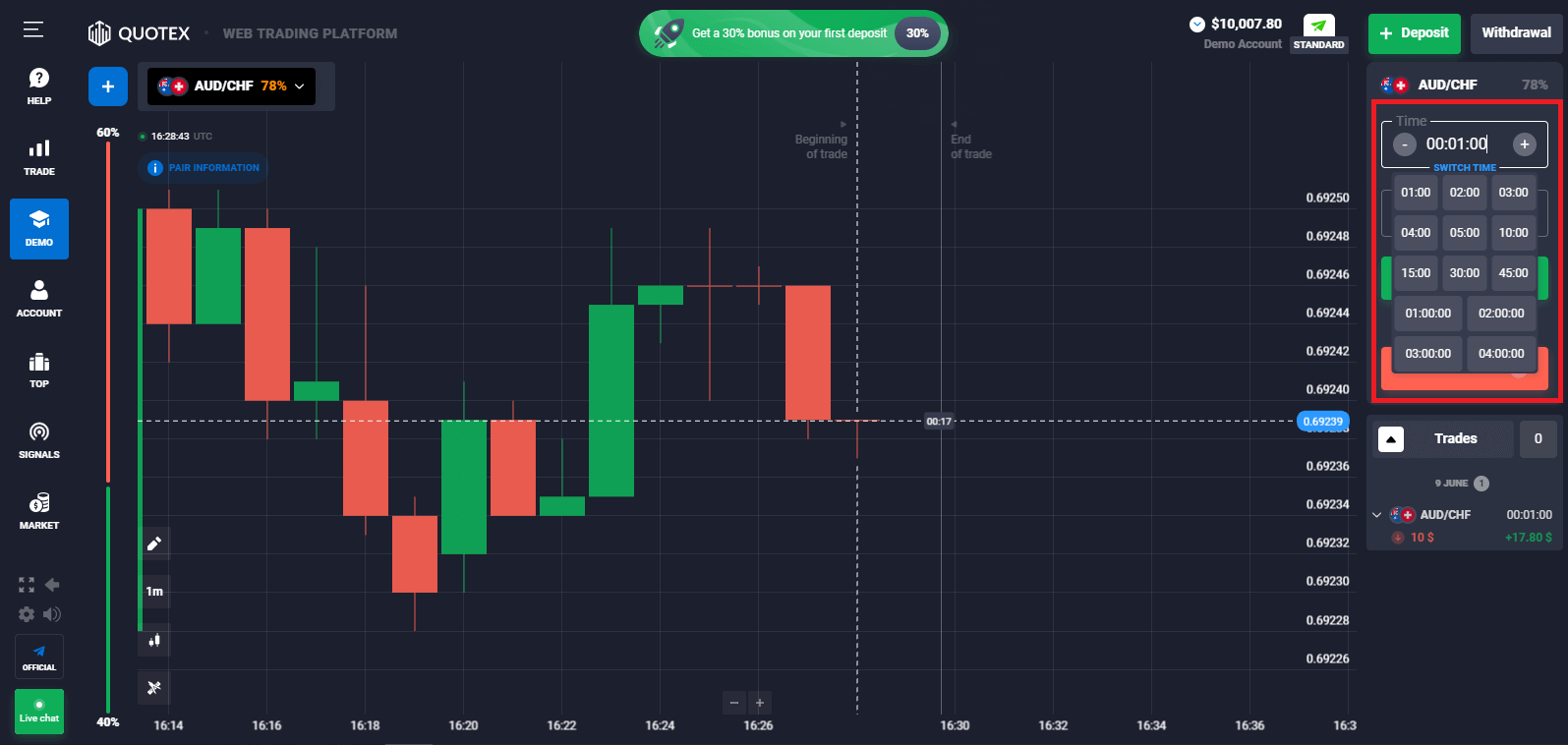

2. Choose an Expiration Time

The expiration period is the time after which the trade will be considered completed (closed) and the result is automatically summed up.

When concluding a trade with digital options, you independently determine the time of execution of the transaction (1 minute, 2 hours, month, etc.).

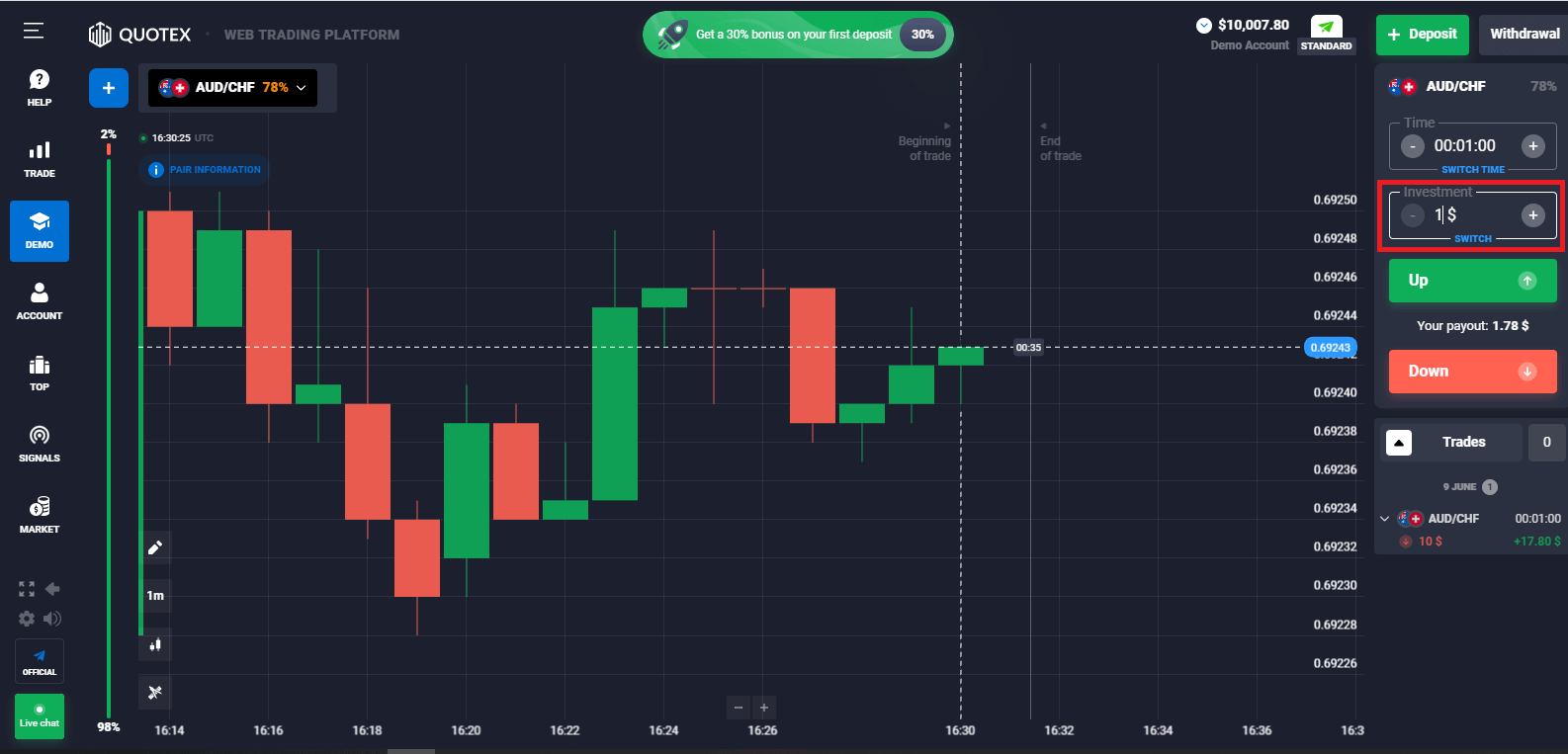

3. Set the amount you’re going to invest. The minimum amount for a trade is $1, the maximum – $1000, or an equivalent in your account currency. We recommend you start with small trades to test the market and get comfortable.

4. Analyze the price movement on the chart and make your forecast. Choose Up (Green) or Down (Red) options depending on your forecast. If you expect the price to go up, press "Up" and if you think the price to go down, press "Down"

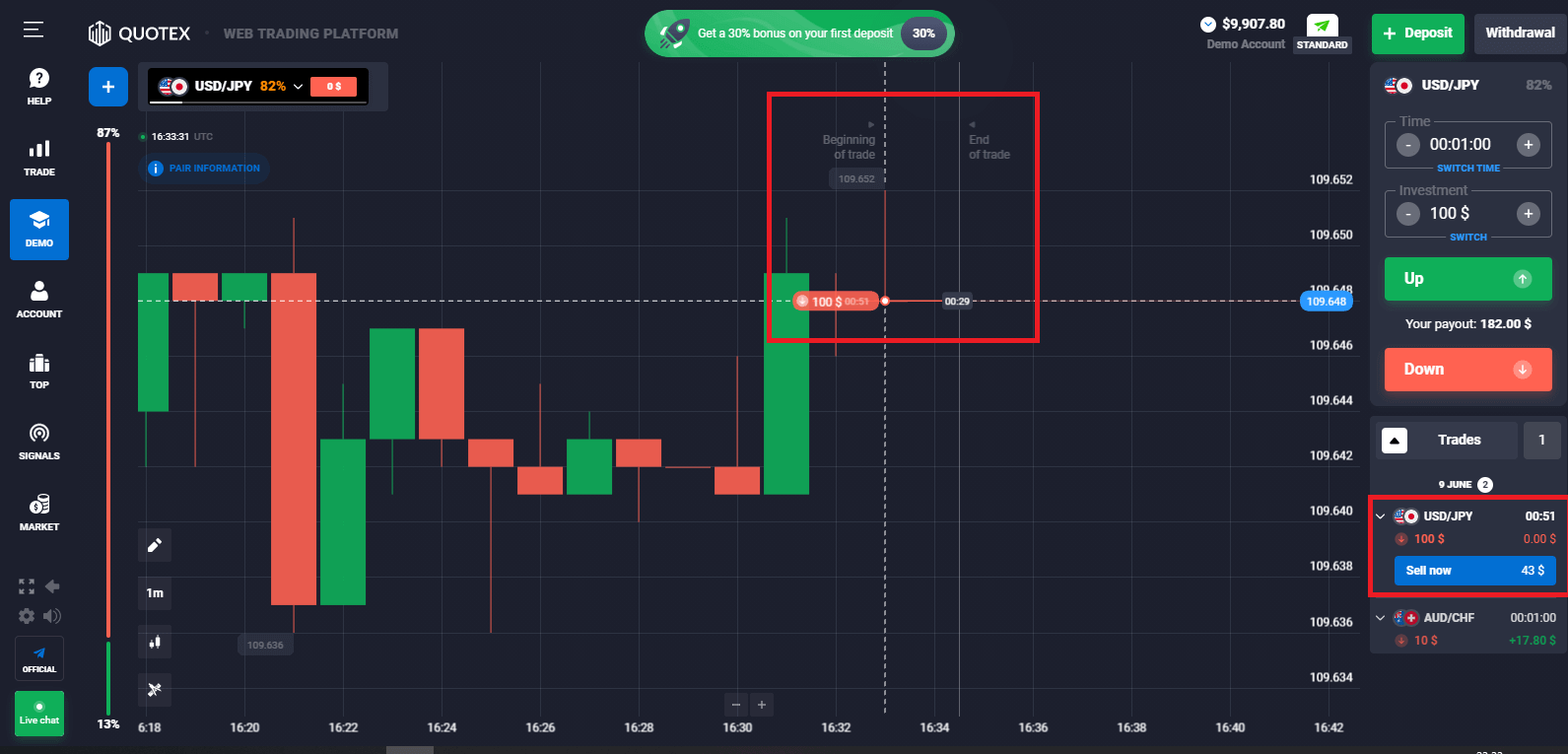

5. Wait for the trade to close to find out whether your forecast was correct. If it was, the amount of your investment plus the profit from the asset would be added to your balance. If your forecast was incorrect – the investment would not be returned.

You can monitor the Progress of your Order under The Trades

Frequently Asked Questions (FAQ)

What are the possible results of the placed trades?

There are three possible outcomes in the digital options market:1) in the event that your prognosis of determining the direction of the price movement of the underlying asset is correct, you receive income.

2) if by the time the option was concluded your forecast turned out to be erroneous, you incur a loss limited by the size of the asset value (i.e., in fact, you can only lose your investment).

3) if the outcome of the trade is zero (the price of the underlying asset has not changed, the option is concluded at the price at which it was purchased), you return your investment.Thus, the level of your risk is always limited only by the size of the asset value.

What determines profit size?

There are several factors that affect the size of your profit:

- the liquidity of the asset you have chosen in the market (the more the asset is in demand in the market, the more profit you will receive)

- the time of the trade (the liquidity of an asset in the morning and the liquidity of an asset in the afternoon can vary significantly)

- tariffs of a brokerage company

- changes in the market (economic events, changes in part of a financial asset, etc.)

How can I calculate the profit for a trade?

You do not have to calculate the profit yourself.A feature of digital options is a fixed amount of profit per transaction, which is calculated as a percentage of the value of the option and does not depend on the degree of change in this value. Suppose if the price changes in the direction predicted by you by only 1 position, you will earn 90% of the value of the option. You will earn the same amount if the price changes to 100 positions in the same direction.

To determine the amount of profit, you must perform the following steps:

- choose the asset that will underlie your option

- indicate the price for which you would have purchased the option

- determine the time of the trade, after these actions, the platform will automatically display the exact percentage of your profit, in case of a correct prognosis

The yield of a digital option is fixed immediately upon its acquisition, therefore you do not need to wait for unpleasant surprises in the form of a reduced percentage at the end of the trade.

As soon as the trade is closed, your balance will automatically be replenished by the amount of this profit.

What is the gist of digital options trading?

The fact is that a digital option is the simplest type of derivative financial instrument. In order to make money in the digital options market, you do not need to predict the value of the market price of an asset that it can reach.The principle of the trading process is reduced only to the solution of one single task - the price of an asset will increase or decrease by the time the contract is executed.

The aspect of such options is that it does not matter to you at all, that the price of the underlying asset will go one hundred points or only one, from the moment the trade is concluded to its close. It is important for you to determine only the direction of movement of this price.

If your prognosis is correct, in any case you get a fixed income.

How to learn quickly how to make money in the digital options market?

To get a profit in the digital options market, you only need to correctly predict which way the price of the asset you have chosen will go (up or down). Therefore, for a stable income you need:- develop your own trading strategies, in which the number of correctly predicted trades will be maximum, and follow them

- diversify your risks

At what expense does the Company pay profit to the Client in case of successful trade?

Company earns with customers. Therefore, it is interested in the share of profitable transactions significantly prevailing over the share of unprofitable ones, due to the fact that the Company has a percentage of payments for a successful trading strategy chosen by the Client.In addition, trades conducted by the Client together constitute the trading volume of the Company, which is transferred to a broker or exchange, which in turn are included in the pool of liquidity providers, which together leads to an increase in the liquidity of the market itself.

What is a trading platform and why is it needed?

Trading platform - a software complex that allows the Client to conduct trades (operations) using different financial instruments. It has also accesses to various information such as the value of quotations, real-time market positions, actions of the Company, etc.

Conclusion: Trade Confidently and Strategically on Quotex

Trading digital options on Quotex is a straightforward and efficient way to capitalize on market opportunities. By selecting the right asset, setting appropriate trade parameters, and leveraging market analysis tools, you can enhance your trading performance. Keep in mind that every trade involves risk, so it’s important to develop a solid strategy and stay informed about market trends.